What Is A Non Taxable Reimbursement . Sars updated their employers guide for tax allowances related to subsistence allowance,. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. In contrast to an allowance, a reimbursement is an “after. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: what is a reimbursement and how is it calculated? employee allowances for the 2023 tax year.

from www.slideserve.com

if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: employee allowances for the 2023 tax year. what is a reimbursement and how is it calculated? In contrast to an allowance, a reimbursement is an “after. Sars updated their employers guide for tax allowances related to subsistence allowance,.

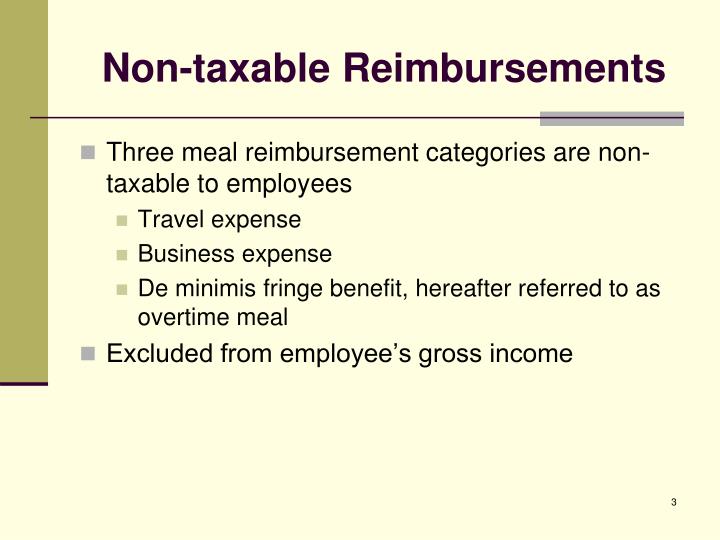

PPT Meal Reimbursements PowerPoint Presentation ID1282699

What Is A Non Taxable Reimbursement in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: Sars updated their employers guide for tax allowances related to subsistence allowance,. what is a reimbursement and how is it calculated? in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: employee allowances for the 2023 tax year. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. In contrast to an allowance, a reimbursement is an “after.

From slideplayer.com

TAXABILITY OF FRINGE BENEFITS PARTS 1 & 2 ppt download What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. Sars updated their employers guide for tax allowances related to subsistence allowance,. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are used to determine the nature of reimbursed travel. What Is A Non Taxable Reimbursement.

From www.full-suite.com

Ultimate Guide on How to Fill Out BIR Form 2316 FullSuite What Is A Non Taxable Reimbursement what is a reimbursement and how is it calculated? employee allowances for the 2023 tax year. In contrast to an allowance, a reimbursement is an “after. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related. What Is A Non Taxable Reimbursement.

From avisqcatherin.pages.dev

What Is The Minimum Taxable For 2024 Taffy Federica What Is A Non Taxable Reimbursement Sars updated their employers guide for tax allowances related to subsistence allowance,. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: employee allowances for the 2023 tax year. In contrast to an allowance, a reimbursement is an “after. what is a reimbursement and how is it calculated? if. What Is A Non Taxable Reimbursement.

From www.nbgcpa.ca

What is NonTaxable in Canada? » NBG Chartered Professional What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related to subsistence allowance,. In contrast to an allowance, a reimbursement is an “after. what is a reimbursement and how. What Is A Non Taxable Reimbursement.

From www.wallstreetmojo.com

Reimbursement Meaning, Types, Examples, How it Works? What Is A Non Taxable Reimbursement In contrast to an allowance, a reimbursement is an “after. what is a reimbursement and how is it calculated? if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related to subsistence allowance,. in the tax context,. What Is A Non Taxable Reimbursement.

From www.taxslayer.com

What Counts as Taxable and NonTaxable What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. In contrast to an allowance, a reimbursement is an “after. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related to subsistence allowance,. in the tax context, two specific. What Is A Non Taxable Reimbursement.

From www.investopedia.com

What Is a Reimbursement, and How Does It Work (With Example)? What Is A Non Taxable Reimbursement what is a reimbursement and how is it calculated? employee allowances for the 2023 tax year. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: Sars. What Is A Non Taxable Reimbursement.

From dxogvbmyb.blob.core.windows.net

Non Taxable Grossed Up at Stanley Theisen blog What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related to subsistence. What Is A Non Taxable Reimbursement.

From www.slideserve.com

PPT Meal Reimbursements PowerPoint Presentation, free download ID What Is A Non Taxable Reimbursement in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. employee allowances for the 2023 tax year. what is a reimbursement and how is it calculated? Sars. What Is A Non Taxable Reimbursement.

From saralpaypack.com

Types of Allowance Taxable, NonTaxable & Partially Taxable What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. what is a reimbursement and how is it calculated? In contrast to an allowance, a reimbursement is an “after. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are. What Is A Non Taxable Reimbursement.

From www.slideserve.com

PPT PowerPoint Presentation, free download ID5767432 What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. In contrast to an allowance, a reimbursement is an “after. what is a reimbursement and how is it calculated? Sars updated their employers guide for tax allowances related to subsistence allowance,. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: if. What Is A Non Taxable Reimbursement.

From slideplayer.com

Academic Year Payroll Topics ppt download What Is A Non Taxable Reimbursement if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: In contrast to an allowance, a reimbursement is an “after. Sars updated their employers guide for tax allowances related. What Is A Non Taxable Reimbursement.

From www.slideserve.com

PPT AP and PR Taxable vs Non Taxable Fringe Benefits PowerPoint What Is A Non Taxable Reimbursement In contrast to an allowance, a reimbursement is an “after. what is a reimbursement and how is it calculated? if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. employee allowances for the 2023 tax year. Sars updated their employers guide for tax allowances related. What Is A Non Taxable Reimbursement.

From scltaxservices.com

Taxable vs. Nontaxable What’s the Difference? SCL Tax Services What Is A Non Taxable Reimbursement if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. In contrast to an allowance, a reimbursement is an “after. Sars updated their employers guide for tax allowances related to subsistence allowance,. in the tax context, two specific codes are used to determine the nature of. What Is A Non Taxable Reimbursement.

From bathroom-remodelings.blogspot.com

What Is NonTaxable What Is A Non Taxable Reimbursement employee allowances for the 2023 tax year. Sars updated their employers guide for tax allowances related to subsistence allowance,. In contrast to an allowance, a reimbursement is an “after. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: if expenditure is incurred as instructed by the employer, proof of. What Is A Non Taxable Reimbursement.

From www.wintwealth.com

Taxable & NonTaxable Allowance for Salaried Individuals What Is A Non Taxable Reimbursement if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. Sars updated their employers guide for tax allowances related to subsistence allowance,. employee allowances for the 2023 tax year. in the tax context, two specific codes are used to determine the nature of reimbursed travel. What Is A Non Taxable Reimbursement.

From www.quanswer.com

What is nontaxable risk allowance? Quanswer What Is A Non Taxable Reimbursement Sars updated their employers guide for tax allowances related to subsistence allowance,. if expenditure is incurred as instructed by the employer, proof of expenditure is provided and the ownership of the asset vests in. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: In contrast to an allowance, a reimbursement. What Is A Non Taxable Reimbursement.

From www.slideserve.com

PPT Meal Reimbursements PowerPoint Presentation ID1282699 What Is A Non Taxable Reimbursement what is a reimbursement and how is it calculated? Sars updated their employers guide for tax allowances related to subsistence allowance,. In contrast to an allowance, a reimbursement is an “after. in the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: if expenditure is incurred as instructed by the employer,. What Is A Non Taxable Reimbursement.